In India, news of fraud worth lakhs and crores are being received through fake GST numbers. Therefore, if you are doing business under GST, then you should also know that the person who is doing a deal with you is not giving a receipt with a fake GST number. In this article, we will know how to check the GST numbers. And what is his status? Along with this, you will also know where you can complain if you get information about such fraud.

Contents

How do I check the GST number?

Here is how to check the GST number of an individual, entity, or company on the GST portal

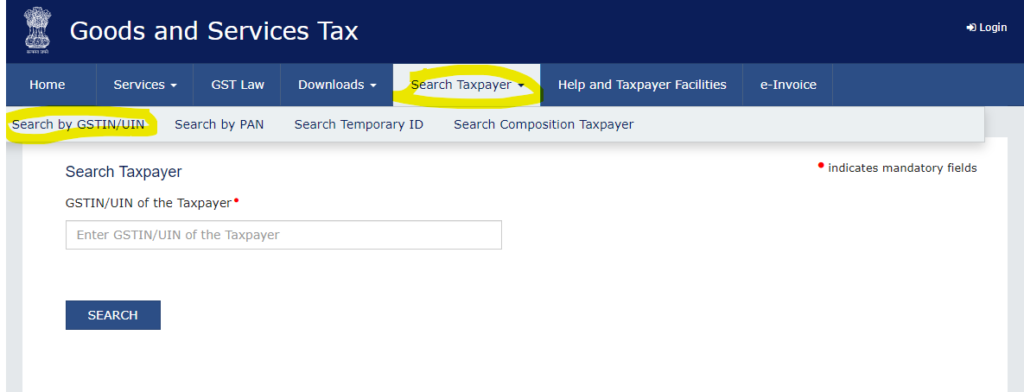

Step 1: Open GST Portal on your computer or mobile

- The link to GST Portal is- https://www.gst.gov.in

- On the homepage that opens, the Search Taxpayer” button appears in the blue bar at the top.Click on it.

Step 2: Now click on the link for Search by GSTIN/UIN

- 4 options open before you-

- Search By GSTIN/UIN

- Search by PAN

- Search Temporary ID

- Search Composition Taxpayer

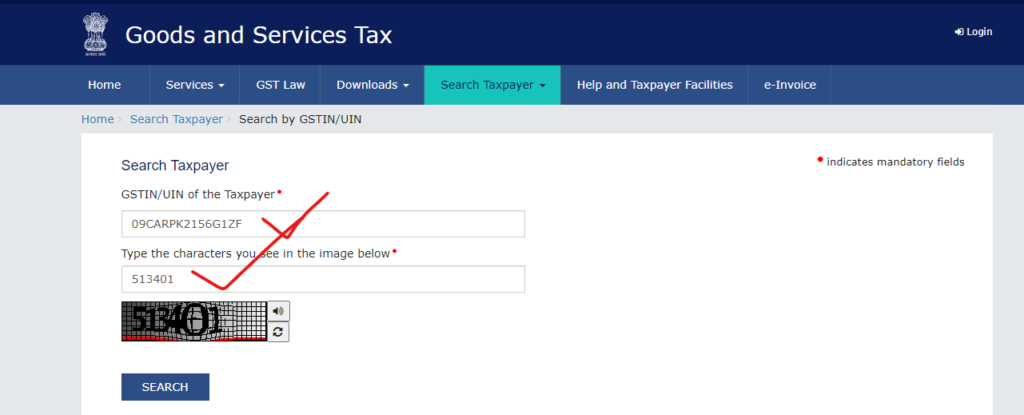

Step 3: Enter the GST number and captcha code and click on the search button

- In the new page that opens, a blank box will appear to enter the GSTIN/UIN number.

- Enter the GSTIN number whose validity is to be checked.

- As soon as you start entering the GSTIN number in this box, another blank box appears below. In this box, you must enter the captcha code. This captcha code is written in the box below. Type it in the empty box.

- Note: On the right side of the captcha code, a speaker symbol appears. You can also listen to this code by clicking on it.

- After entering the GSTIN number and captcha code, click on the “Search” button below.

Step 4: All the details of that company or person will appear on the screen

On pressing the search button, the main details related to that GSTIN number appear below. such as-

- GSTIN/UIN: GSTIN or UIN number of that business or organization

- Legal Name of Business: The name under which that business or organization is registered.

- Trade Name: The name by which it is commonly known

- Date of Registration: The date on which the GST registration number was issued.

- Constitution of Business: Under what type of management the business is run – such as Proprietorship/Partnership/Private Company/Public Company/NGO/LLP

- Taxpayer Type: A normal registered businessperson or one registered under composition or any other category.

- GSTIN/UIN Status: Whether the registration number is active, pending, or cancelled.

- Administrative Office: The address of the office from which the administrative activities are conducted.

- Other Office: The address of any other offices that have been kept.

- Principal Place of Business: From where the transaction, manufacture, or service is made available.

- Nature of Business Activities: What kind of business are you engaged in?

Checking GST Number from PAN Card

The method to check GSTIN through a PAN number is also like the method mentioned above. In brief, its method is also explained here-

- Go to the homepage of the GST Portal

- Click on Search Taxpayer

- Click on Search By PAN

- Enter the PAN number in the first empty box

- Enter the captcha code in the second empty box

- Finally, press the Search button

- As soon as you press the search button, information about all the GSTIN/UIN numbers related to that PAN number will appear on the screen below.

How to check GST ID received temporarily

- Go to the homepage of the GST Portal

- Click on Search Taxpayer

- Click on the link for Search Temporary ID

- Enter the temporary ID or mobile number registered in the GST portal

- Enter the captcha code and click on the search button

- With this, you will see the details related to that Temporary ID

How do I check the validity of the composition scheme?

If a business is registered under the composition scheme of GST, then its GST registration number can also be checked. In short, its method is as follows-

- Go to the homepage of the GST Portal

- Click on Search Taxpayer

- Click on Search Composition Taxpayer

- Choose the choice of opted in or opted out

- Enter GSTIN/UIN number in the prescribed box

- Enter the captcha code in the box below

- Finally, press the Search button

- On this page, key information related to that GSTIN number will appear on the screen. (Similar to method number one)

What is the GST number?

The full form of the GST number is the GST Identification Number (GSTIN). However, it is also known colloquially as the “GST” number. It is a 15-digit alpha-numeric number, which is available on the registration form for GST. Alpha-numeric means that the number has both the letters of the alphabet (ABCD) and the letters of the alphabet. For example, Paytm Payments Bank Limited’s GST number in Uttar Pradesh is -09AAICP7470Q1ZG. It also includes your state code and your PAN number. In any GST number, the following information is hidden in the included 15 digits-

First two digits: This is the state code of that person or organization. The state in which that business runs such as.

- For Delhi -07

- For Uttar Pradesh-09

- For Madhya Pradesh – 23

- For Haryana-06

- For Punjab-03

- For Bihar-10

- For Rajasthan-08

- For Maharashtra – 27

- For Gujarat-24

- For Bengal-19

- Next 10 digits: These are the 10 digits of your PAN (permanent account number). remain included in the GST number.

- 13th digit: This is the serial number of your business or establishment in that state.

- 14th digit: It is the same as Z in every GST number

- 15th digit: It can be in the form of an alphabet or number, which is in the form of a check code set by the computer.

What is the GST?

Attention to the PAN holder, is your PAN getting deactivated?

Difference between GSTIN and UIN number

There are two types of registration numbers issued by the GST department. GSTIN number and UIN number. What is the difference between these two? Who gets what kind of number first?

GSTIN

Its full name is the Goods and Services Taxpayer Identification Number. “A Goods and Services Taxpayer Identification Number.” It is 15 digits, which also includes the PAN number of that person or institution. In common parlance, it is also called a GST number. A GSTIN number is issued to such businesspeople or organizations that are responsible for paying taxes to the government in India.

People in this category deduct GST on their deals and then deposit it with the government.

UIN

Its full name is “Unique Identification Number,” and it translates to “Unique Identification Number” in Hindi. A UIN number is a type of GST registration number. It is issued to individuals or institutions that are not liable to pay tax in India. Such as United Nations (UNO) agencies, foreign embassies (Consulate or Embassy), etc.

Even if tax is collected from this category of people or institutions, it is later refunded through the prescribed procedure.

So, reader, this was the information about checking the GST number. Check out our articles for other useful information related to tax, saving, and investing.

Follow on Google News